Q.3.1 Scope and definitions

The Treaty on the Functioning of the European Union (TFEU) lays down that ‘the Union and the Member States will counter fraud and any other illegal activities affecting the financial interests of the Union’.¹

¹ Article 325(1) of the Treaty on the Functioning of the European Union (TFEU)

The EU regulations give detailed definitions of related terms which can be detected on project partner, project or Programme levels:

‘irregularity’ means any breach of applicable law, resulting from an act or omission by a legal entity involved in the project implementation, which has, or would have, the effect of prejudicing the budget of the Union by charging unjustified expenditure to that budget

REGULATION (EU) 2021/1060, Article 2 (31) in combination with (30)

‘systemic irregularity’ means any irregularity, which may be of a recurring nature, with a high probability of occurrence in similar types of operations, which results from a serious deficiency, including a failure to establish appropriate procedures in accordance with the Common Provisions Regulation and the Fund-specific rules, and

REGULATION (EU) 2021/1060, Article 2(33)

‘fraud’ means any intentional act or omission relating to the use or presentation of false, incorrect or incomplete statements or documents, non-disclosure of information in violation of a specific obligation or misapplication of funds for purposes other than those for which they were originally granted², thus affecting the Union's financial interests. Fraud is further divided into three specific types by the Association of Certified Fraud Examiners (ACFE)³: intentional manipulation, misappropriation and corruption.

² Convention drawn up on the basis of Article K.3 of the Treaty on European Union

³ More details on fraud in the “Information Note on Fraud Indicators for ERDF, ESF and CF” (COCOF 09/0003/00-EN)

Irregularities include fraud. It is the element of intentional deceit, which distinguishes ‘fraud’ from the more general term of ‘irregularity’.

Please note

No complete and exhaustive list can be given of what is and what is not an irregularity — decisions can only be taken with reference to particular cases, and are therefore subject to institutional judgment. In specific instances two questions should be asked:

a) Have rules been broken? And

b) If so, might this have a negative impact on the EU budget? ⁴

Any ineligible expenditure detected and deducted before the MA/JS declared the expenditure to the Commission will not be subject to the following irregularity procedure. ⁵

⁴ Handbook on “Reporting of irregularities in shared management” 2017, European Anti-Fraud Office (Directorate D — Policy, OLAF.D.2 — Fraud Prevention, Reporting and Analysis)

⁵ REGULATION (EU) 2021/1060, Art 103

Q.3.2 Introduction to the irregularity procedure

The MA/JS is the central point for assessing and following up irregularities.

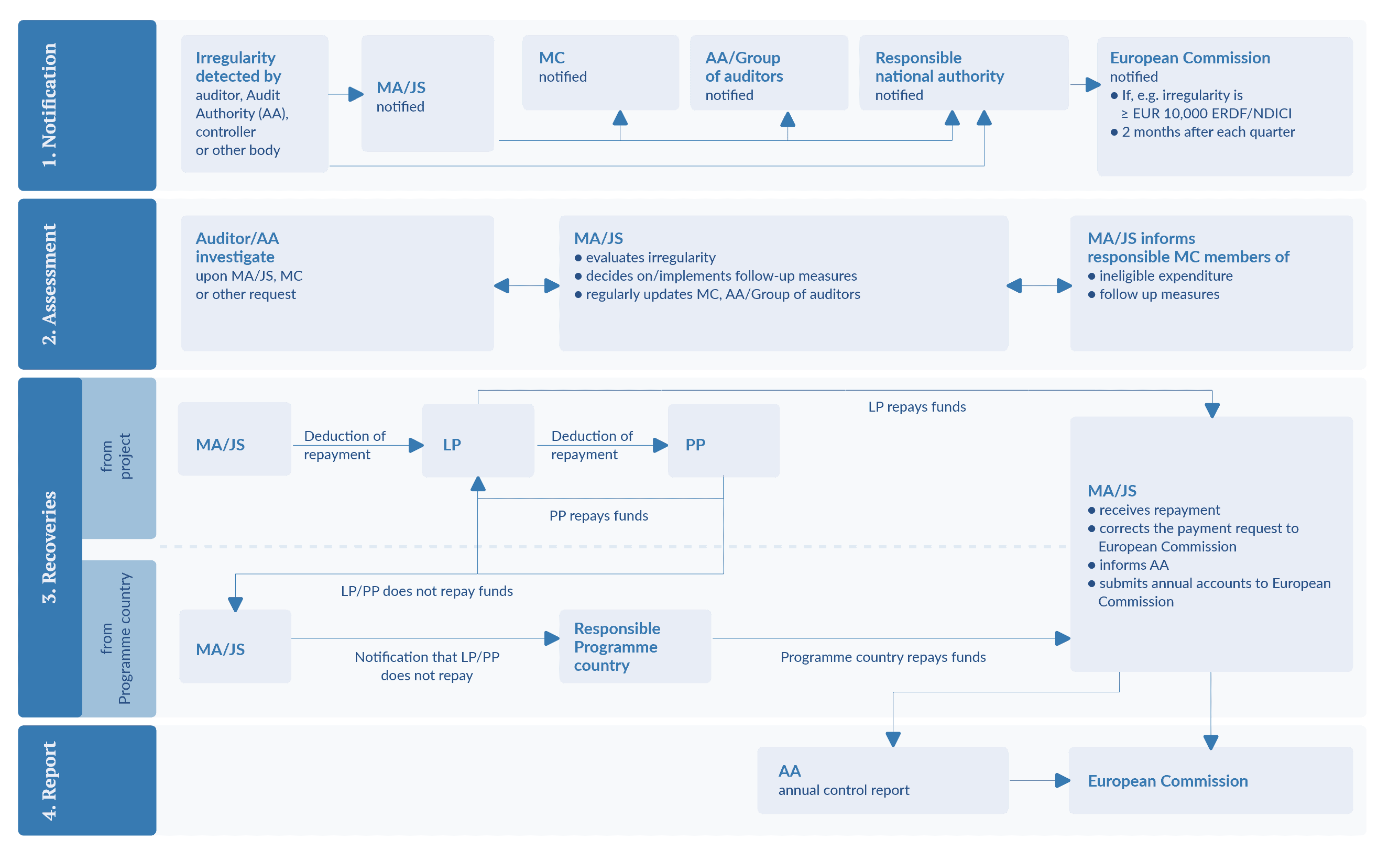

The irregularity procedure¹ is divided into several steps, namely:

¹ The procedure complies with the legal requirements of the EU as well as the Programme rules, in particular REGULATION (EU) 2021/1059, Art 52, REGULATION (EU) 2021/1060, Art 69(2), 98(6, 7), 103(1-3) and Annex XII, as well as Programme Document, chapter 7.3.

1) Detection and notification of irregularities;

2) Assessment of irregularities;

3) Implementation of follow-up measures on project level;

4) Reporting

Q.3.3 Step 1 – Detection and notification of irregularities

Irregularities can be detected during implementation or closure of a project, as well as after the project end date. Consequently, the irregularities found by different authorities or bodies, e.g. the national auditors, have to be made known to the MA/JS and Audit Authority, as soon as possible. Such notifications have to be in written form and give details that allow the MA/JS or other bodies to carry out an assessment of the case reported. Furthermore, the information should provide sufficient detail to investigate whether the case is subject to irregularity or fraud with all its consequences.

In addition, the body/authority detecting the irregularity has to directly notify the respective national authority responsible for reporting to the European Anti-Fraud Office (OLAF) in cases of irregularities above EUR 10,000 of ERDF. The national authority has to report to OLAF within two months following the end of each quarter from the detection of the respective irregularities or as soon as additional information on the reported irregularities becomes available. In cases where the irregularities may have repercussions outside the country of the project partner, the national authority has to immediately report to the Commission any irregularities discovered or believed to have occurred, indicating any other Member States concerned.¹ Such reporting does not have to be done in the following cases²:

¹ REGULATION (EU) 2021/1060, Annex XII, Point 1.4

² REGULATION (EU) 2021/1060, Annex XII, Point 1.2

a. irregularities for an amount lower than EUR 10,000 of ERDF,

b. irregularities that consist solely of the failure of a project partner to execute, in whole or in part, a project due to non-fraudulent bankruptcy,

c. cases brought to the attention of the MA/JS by the project partner voluntarily and before detection by the MA/JS,

d. cases which are detected and corrected before inclusion in a payment application submitted to the Commission.

The exemptions in points (c) and (d) do not apply to irregularities that give rise to the initiation of administrative or judicial proceedings at national level in order to establish the presence of fraud or other criminal offences.

Q.3.4 Step 2 – Assessment of irregularities

According to the nature and details of irregularity, the MA/JS will decide if the information received is sufficient to proceed with an assessment, conclusions and a proposal for follow-up measures. Should further information/expertise be needed the MA/JS can ask for support from:

The respective national auditor or the Programme’s Audit Authority,

An external independent third body that is an expert in that field,

The participating country concerned,

The controller concerned.

Q.3.5 Step 3 – Implementation of follow-up measures on project level

The MA/JS will communicate the follow-up measures to be taken to the lead partner and to the project partner concerned.

Q.3.5.1 Recoveries

The MA/JS will ensure that any Programme co-financing paid as a result of an irregularity is recovered from the lead partner¹ through deduction or repayment as follows:

¹ REGULATION (EU) 2021/1059, Article 52(1)

1.) Deduction

Deduction from respective project

There are open payment claim(s) of the respective project and the irregular amount can be (partly) covered from the same co-financing source, e. g. ERDF.

Deduction from other project(s)

The partner concerned has open payment claim(s) in other project(s) of the Programme and the irregular amount can be (partly) covered from it.

Deduction from respective project

The MA/JS deducts the irregular amount from the open payment claim(s) of the same co-financing source of the same project.

Deduction from other project(s)

The MA/JS deducts the irregular amount from the open payment claim(s) of the partner in other projects of the Programme.

Deduction from respective project

The project receives a reduced reimbursement from the MA/JS.

Deduction from other project(s)

The other project(s) receives a reduced reimbursement from the MA/JS.

Deduction from respective project

The reduction affects either the partner who caused the irregularity or the entire project partnership, if the amount in question cannot be deducted in full from the partner who caused the irregularity.

Deduction from other project(s)

The reduction affects only the partner who caused the irregularity.

The MA/JS decides which of the deduction options to apply. It may also apply both options in parallel to deduct the major part of the undue amount from payment claims of the partner who caused the irregularity.

Where the amount in question has to be deducted from payment claims of partners not causing the irregularity, the chain of financial liability outlined after point 2) applies.

2.) Repayment

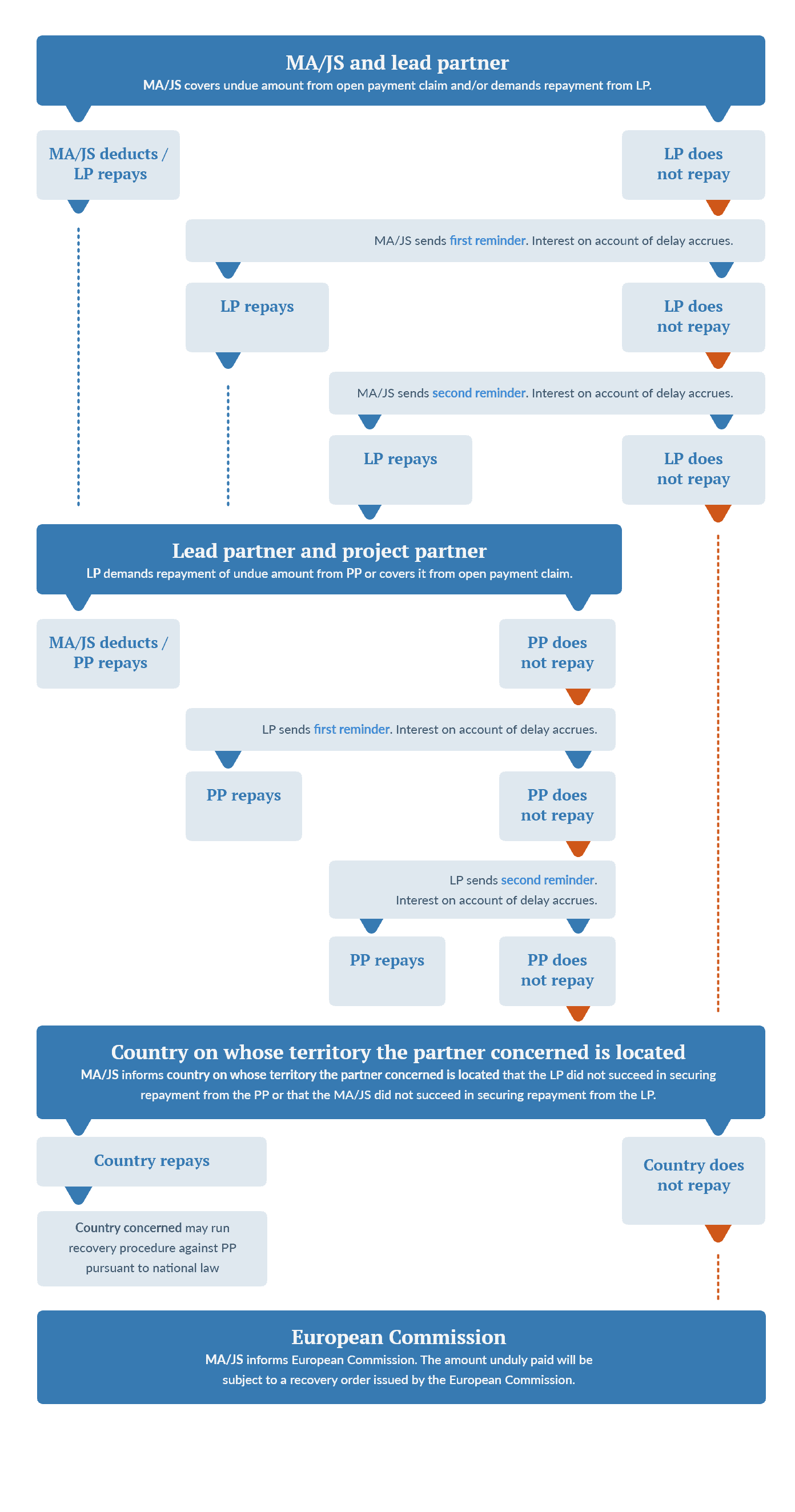

In case there is no or not enough open payment claim(s) to deduct the irregular amount, the MA/JS will ask the lead partner to pay back the irregular amount to the relevant programme account. The MA/JS compiles the documentation and sends a recovery letter to the lead partner specifying the repayment amount and exact recovery date.

The lead partner is obliged to transfer the repayment amount. The payment has to arrive on the programme account within one calendar month following the date of the letter of the MA/JS asserting the repayment claim. Any delay in effecting the repayment gives rise to interest on account of late payment, starting on the due date and ending on the value day of actual repayment. The rate of such interest will be one-and-a-half percentage points above the rate applied by the European Central Bank in its main refinancing operations on the first working day of the month in which the due date falls.² Should the lead partner not pay back by the recovery date, the MA/JS will send a written reminder. In this reminder the MA/JS will set another deadline which is one calendar month following the date of the reminder. If the lead partner does not pay back by the deadline of the first reminder, the MA/JS will submit a second and final written reminder, making the lead partner aware of the legal consequences of a failure to repay. Should the lead partner not pay back after the deadline of the second and final reminder, the MA/JS will not have succeeded in securing repayment from the lead partner.³

² REGULATION (EU) 2021/1060, Article 88(2)

³ REGULATION (EU) 2021/1059 Article 52 (3) sentence 1

Chain of financial liability

Under Interreg programmes there is no scope for irrecoverable amounts at the level of project partners.⁴ Article 52 of Regulation (EU) 2021/1059 establishes a clear chain of financial liability from project partners via lead partners and the MA/JS to the European Commission. It also makes provisions for liability of Member States and third countries:

⁴ REGULATION (EU) 2021/1059, Recital 33

Partners must repay the lead partner any amounts unduly paid in line with the partnership agreement.⁵ For this purpose, the lead partner will submit to the project partner(s) concerned a recovery letter specifying the repayment amount and the exact recovery date. The payment has to arrive on the lead partner’s account within one calendar month following the date of the letter of the lead partner asserting the repayment claim. Any delay in effecting the repayment gives rise to interest on account of late payment, starting on the due date and ending on the value day of actual repayment. The rate of such interest will be one-and-a-half percentage points above the rate applied by the European Central Bank in its main refinancing operations on the first working day of the month in which the due date falls.⁶ Should the partner not pay back by the recovery date, the lead partner will send a written reminder. In this reminder the lead partner will set another deadline which is one calendar month following the date of the reminder. If the partner does not pay back by the deadline of the first reminder, the lead partner will submit a second and final written reminder, making the partner aware of the legal consequences of a failure to repay. Should the partner not pay back after the deadline of the second and final reminder, the lead partner will inform the MA/JS and prove that it did not succeed in securing repayment from the partner.⁷

Where the lead partner does not succeed in securing repayment from the respective project partner(s) or where the MA/JS does not succeed in securing repayment from the lead partner, the country on whose territory the partner concerned is located or, in the case of an EGTC, is registered, will reimburse the MA/JS any amounts unduly paid to that partner.

REGULATION (EU) 2021/1059, Art 52(3)

The MA/JS will inform the MC members of the country concerned. This information will include proof that the lead partner or MA/JS has undertaken all necessary steps to secure repayment as outlined above, but did not succeed.

Once the country has reimbursed the MA/JS any amounts unduly paid to a partner, it may continue or start a recovery procedure against that partner pursuant to its national law.

REGULATION (EU) 2021/1059, Art 52(4)

Where the country has not reimbursed the MA/JS any amounts unduly paid to a partner pursuant to the point above those amounts will be subject to a recovery order issued by th the European Commission.

REGULATION (EU) 2021/1059, Art 52(5)

Figure 9 Recovery procedure (incl. chain of financial liability)

If a financial irregularity is based on a systemic irregularity, the project might have to apply measures retrospectively.

Projects that are the subject of irregularities cannot reuse the deducted or repaid amounts.⁸ This means that the amount unduly paid reduces the Programme co-financing the partner is entitled to receive.

⁸ REGULATION (EU) 2021/1060, Article 103(3)

Q.3.5.2 Recovery of unlawful State aid

When the detected irregularity concerns unlawful State aid, the Programme has the obligation to implement specific procedures. These aim to restore the market to its state before the State aid was paid.⁹ Therefore, the MA/JS has to ensure recovery of the illegal and unlawful aid from the project partner with the aim of removing the undue advantage granted to it.

⁹ See Judgment of the Court of Justice of 11 December 2012, Commission v Spain (‘Magefesa II’), C-610/10, ECLI:EU:C:2012:781, paragraph 105

The European Commission defines unlawful aid as new aid implemented without notification to or before its approval by the EU Commission.¹ In the Programme, project partners receive unlawful aid if they do not satisfy the conditions laid down by the GBER or the de minimis Regulation. This is the case, for example, if a project partner that receives aid under Article 20 of the GBER did not inform the MA/JS that it had already been granted State aid by another funding authority for the same eligible costs. Or, for example, if a project partner already reached its de minimis allowance, but provided false information in the de minimis declaration and thus received Programme co-financing which exceeds the limits.

¹ See Communication from the Commission — Commission Notice on the recovery of unlawful and incompatible State aid, C/2019/5396, OJ C 247, 23.7.2019, p. 1–23, paragraph 13

Two scenarios then apply:

The European Commission decides that the aid is illegal and incompatible and requires its recovery. In this case, the process of recovery and the aid to be recovered is determined by the Commission decision itself. The decision also identifies the Member State charged with recovery. The identified Member State has to implement the decision in accordance with national law, with the objective of re-establishing the situation that existed on the market prior to the granting of the aid, within the four months following the adoption of the decision. Full implementation of the decision is achieved by suspending any further granting of aid to the beneficiary that received illegal and incompatible aid and by recovering all the aid element, which is made up of the aid principal and the recovery interest, as defined in the decision.

A body other than the European Commission identifies the illegal and unlawful aid. If it was not the MA/JS, it informs the MA/JS. In this case, the MA/JS will undertake recovery on its own initiative. The recovery procedure outlined in the previous chapter applies, with the following additional requirements:

The MA/JS must terminate the implementation activities of the project partner, and

See Communication from the Commission — Commission Notice on the recovery of unlawful and incompatible State aid, C/2019/5396, OJ C 247, 23.7.2019, p. 1–23, paragraph 13.

It is the duty of the MA/JS to claim interest from the project partner concerned. The project partner must pay, inter alia, interest for the whole of the period over which it benefited from that aid and at a rate equivalent to that which would have been applied if it had to borrow the amount of the aid at issue on the market within that period.[1] By paying the recovery interest the project partner forfeits the financial advantage arising from the availability of the aid in question from the date it was put at the disposal of the beneficiary until it is paid back.[2] The MA/JS will calculate the interest with the recovery interest calculator provided by the European Commission. [3]

[1] See Judgment of the Court of Justice of 5 March 2019, Eesti Pagar, C-349/17, ECLI:EU:C:2019:172, point 5

[2] See Judgment of the Court of First Instance of 8 June 1995, Siemens v Commission, T-459/93, ECLI:EU:T:1995:100, paragraphs 97-101.

[3] https://ec.europa.eu/competition-policy/state-aid/procedures/recovery-unlawful-aid_en

Q.3.5.3 Non-financial follow-up measures

Irregularities without financial consequences, can be, for example, errors in documentation or systemic irregularities (i.e. irregularities of a recurring nature e.g. in the accounting procedures). In such cases the MA/JS will ask the lead partner to apply non-financial follow-up measures (e.g. in management structures, of accounting procedures). Depending on the finding the lead partner might have to apply the measures retrospectively.

Q.3.5.4 Other corrective measures

Depending on the case, irregularities might lead to amendments of the project’s subsidy contract as well as to its termination or partial termination.

Q.3.6 Step 4 – Reporting

After the follow-up measures are implemented and, if applicable, the irregular amount recovered, the MA/JS informs the following bodies about the closure of the case:

AA/Group of Auditors,

MC,

If relevant, national authorities of the respective country,

The European Commission.

Furthermore, based on the assessment and case information the MA/JS implements the recoveries and other related corrections in the payment claim to the European Commission. Finally, the MA/JS submits to the European Commission the annual accounts including information on withdrawals by 15 February following the accounting year of the withdrawal.¹

¹ REGULATION (EU) 2021/1060, Article 98(3)(b) and Appendix 2 of Annex XXIV of the same regulation

Figure 10 Example of the procedure for an irregularity requiring a standard financial correction

Q.3.7 Corrections on Programme level

Systemic and other types of irregularities might also be detected at Programme level. These might lead to consequences such as financial corrections or interruption/suspension of payments at the Programme level. For example, if a participating country does not comply with its duties, the MA/JS is entitled to suspend payments to all project partners located on the territory of this participating country.

When errors detected at Programme level result in financial corrections, these might lead to financial adjustments at project level or to adjustments in the available support to applicants and beneficiaries/project partners. They might affect projects during their implementation or closure phase, as well as after the project end date.

Where the European Commission interrupts/suspends payments at Programme level, the overall liquidity of the Programme is affected. The MA/JS will do its utmost to clarify the issue with the European Commission and to lift the interruption/suspension of payment. Nevertheless, this might lead to interruption of payments at project level depending on the availability of funds on the Programme accounts.

The MA/JS will inform lead partners in all cases when an impact at project level is inevitable.