Insights on freight transport in Central Finland

20 August 2025

Overall rail freight status from Finland to Europe & Baltic

Restrictions on rail connections from Finland to the other Nordic countries and elsewhere in Europe are caused by, among other things, the exceptional track gauge. Especially with the changes in the operating environment related to freight transport, the changed needs of military mobility and the new TEN-T Regulation, there has been a need to examine connections implemented on the European track gauge in Finland. The first issue is the extension of European gauge rail connections from Haaparanta to the Finnish side and the construction needs of possible new rail connections to be built on European gauge from Finland to Sweden.

The opportunities to integrate Finland into the rest of Europe’s transport system in other new ways are also more clearly highlighted than before. The fixed connection between the Kvarken (Vaasa-Umeå) has become a project to be investigated. It examines both the rail and road connections, the method of implementation of the connection (embankment, bridge, tunnel) and the demand for traffic. One of the new solutions on the table in the direction of Estonia is the connection of the Finnish railway network to the Baltic railway network or the future Rail Baltica with a train ferry connection.

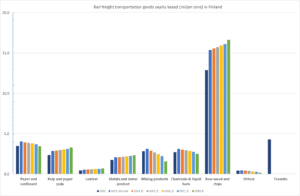

Rail transportation on year 2023

In 2023, a total of around 27 million tonnes of goods were transported in rail freight traffic. This was a decrease of about 13% compared to the previous year. The last time so little goods were transported by rail was at the end of the 1970’s. The low transport volume was affected by the decrease in Russian traffic and the weak economic situation in heavy industry. However, the average transport distance increased, so the decrease in tonne-kilometres was slightly smaller than the tonnes. The decrease in Russian traffic has still been partly compensated for by new domestic transports.

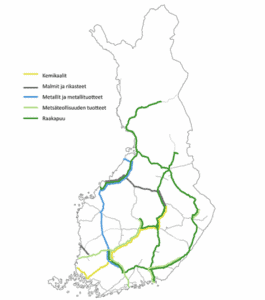

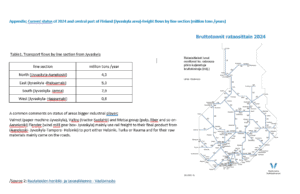

Transport volumes decreased on almost all railway sections in southern and eastern Finland, mainly due to a decrease in Russian traffic. In addition, there was a clear decrease in transport volumes in northern Finland on the Vartius–Oulu–Kokkola and Ylivieska–Iisalmi–Siilinjärvi railway sections. There was an increase in transport volumes, e.g. north of Oulu and on the Pietarsaari–Pännäinen–Kokkola and Tampere–Jyväskylä–Pieksämäki railway sections. Transport volumes decreased in all groups of goods except for roundwood transports. Finnish main rail operator VR’s modal share of rail freight traffic is approximately 91%. The combined share of North Rail and Fenniarail is about nine per cent. In 2023, the modal share of rail freight transport in land transport modes was around 21 per cent.

Goods on track and 2030 forecast in Finland

The forecast for rail freight transport is based on the forecast prepared in 2022, i.e. the estimates of future development did not change in the 2024 update, as the production scenarios for heavy industry and the estimates of changes in production used as the starting point for the economic forecast have not changed significantly. The forecasts have also had to assume that rail freight transport between Finland and Russia will cease completely.

In 2030, the transport volume is estimated to be 30.7 million tonnes. Tons. The end of Russian wood imports will significantly increase the use of domestic roundwood, which will increase the transport volumes of several railway sections. After 2030, rail transport volumes are expected to change only slightly, as production forecasts are expected to be stable from year to year, especially in the forest industry. The share of roundwood transport in all rail transport is estimated to grow to over 50 per cent. As a whole, the share of forest industry companies in transports will rise to about 75 per cent. The forecasts involve significant uncertainties and may be affected by, for example, companies’ goals in reducing carbon dioxide emissions, possible rail transports by large units, the route choices of railway companies or the competition of ports for transport customers.

There have been no significant changes in the operation environment starting point of railway goods transport, and the forecast have therefore not been changed from the previous forecast. The total number of transport volumes is therefore estimated to remain at a clearly lower level than the current level throughout the entire forecast period.

Summary

1. Rail freight transport has decreased significantly over the past few years, and the decline has continued in early 2024.

2. The use of the railway network in transport is concentrated in Finland. The ten companies that use rail the most are responsible for more than 90% of all domestic rail transport. In freight transport, railways play a major role, especially in the forestry, metal and chemical industries.

3. Industrial investments, production reductions and changes in the operating environment can have a rapid impact on the transport flows of the rail network. In recent years, rail freight transport and, consequently, the need to improve and develop the railway infrastructure have been particularly affected by the consequences of Russia’s war of aggression against Ukraine, industrial investments and the industrial downturn.