Energy system and storage infrastructure in Lithuania

07 November 2024

Key characteristics of the energy system in Lithuania

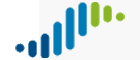

The National Energy Independence Strategy (NEIS) is designed to bring about fundamental changes in the energy sector. One of the main ones is the replacement of fossil fuels with climate-neutral energy sources, which will change the whole energy chain from production to transmission and consumption. Electrification of the energy sector and growth in electricity demand are projected to be the most prominent trends in the energy sector by 2050 (Fig. 1).

Electricity consumption is estimated to increase more than 6-fold by 2050, from the current demand of 12 TWh to a projected 74 TWh. The largest share of the growth will come from synthetic gas production (35.5 TWh), industrial consumption (12.6 TWh), transport consumption (6.3 TWh), and the heat sector (3.4 TWh).

According to the National Energy Independence Strategy, there are three main sectors, where the development of RES is planned and accounted for in the National statistics of Lithuania: the electricity sector, the district heating/cooling sector, and the transport sector.

Figure 1: Key indicators for RES in Lithuania (Source: National Energy Independence Strategy)

The Strategy has 4 main objectives – to ensure a secure and reliable supply of energy to all consumers, to achieve 100% climate-neutral energy for Lithuania and the region, to transition to an electricity economy and develop a high value-added energy industry, as well as to ensure the accessibility of energy resources for consumers.

The share of RES till the year 2022 is shown in Table 1, however, we should mention that significant changes have occurred already after the year 2022 since the start of the war in Ukraine due to the political decision to refuse to use Russian natural gas in Lithuania.

Table 1. The share of RES in consumption 2018-2022, in percent (Source: Atsinaujinantys energijos ištekliai – Oficialiosios statistikos portalas)

| 2018 | 2019 | 2020 | 2021 | 2022 | |

| In final gross energy consumption, % | 25.5 | 25.5 | 27.4 | 28.1 | 29.6 |

| In final energy consumption for heating and cooling, % | 46.0 | 47.4 | 50.2 | 48.6 | 51.8 |

| In gross consumption of electricity, % | 18.4 | 18.8 | 20.2 | 20.9 | 25.5 |

| In final energy consumption in the transport sector, % | 4.3 | 4.0 | 5.5 | 6.7 | 6.3 |

Electricity sector

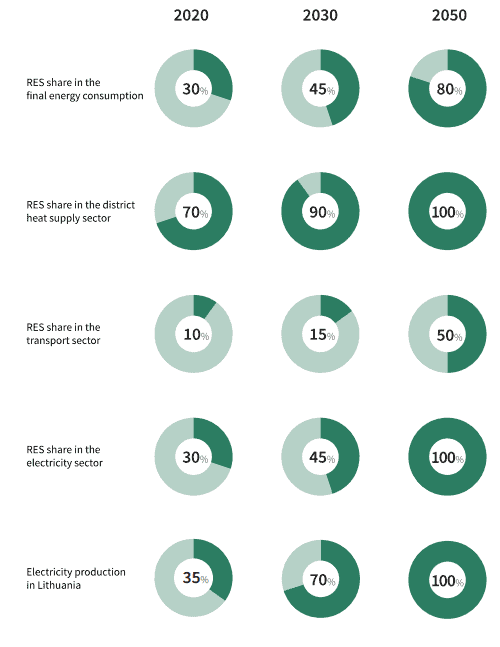

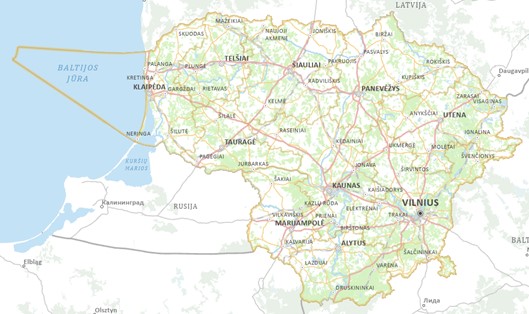

“Litgrid is the electricity transmission system operator (TSO). It manages Lithuania’s electricity transmission network and is responsible for its development. Its main function is to ensure the efficient and reliable operation of the Lithuanian electricity system. In this capacity, we take care of the integrity and compatibility of the country’s electricity system. as well as the management, operation and coordinated development of the transmission network and interconnectors with other electricity systems (Fig. 2).

Lithuania’s 400-330-110 kV electricity transmission network comprises 239 transformer substations and switching stations and 7289.3 km of electricity transmission lines and cables. The installed capacity of 400 kV transformers is 3163.5 MW, that of 330 kV transformers is 5448.5 MW and that of 110 kV transformers is 92.6 MW.

“Litgrid plans the development of the Lithuanian electricity transmission network every year, reconstructs network facilities such as high-voltage transmission lines, and transformer substations, and builds new high-voltage overhead and cable power lines. Lithuania’s electricity transmission network is connected to some of its neighbouring electricity systems: four 330 kV and three 110 kV lines connect Lithuania to Latvia, four 330 kV and seven 110 kV lines connect Lithuania to Belarus, three 330 kV and three 110 kV lines connect Lithuania to the Kaliningrad region, one 300 kV DC cable connects Lithuania to Sweden and two 400 kV lines connect to Poland. In addition, the company is implementing the country’s strategic goal of reorienting the electricity system for synchronous operation with continental European electricity networks, which should take place in February 2025.

The installed capacities for electricity generation consist of non-renewable CHP (fuel mix) – 338 MW; natural gas CHP – 1166 MW; other – 1005 MW; renewables – 2933 MW. Total capacity – 5442 MW.

Further development: In the first half of the year 2024. solar and wind power plants generated almost 70%. Preliminary data show that these plants will generate 2.31 GWh of electricity in 2024. Also, in the year 2024. the renewable energy sources’ allowed generation capacity on the grid increased by one-fifth to 2 885 MW on 1 July, and the national electricity generation doubled to fully cover the country’s population’s electricity needs in half a year. This was recorded on Sat. 11 March and 3 May.

Figure 2. Map of Lithuanian Electricity Grid – Lithuania – National Energy Grids

According to Litgrid’s (Lithuania’s electricity transmission system operator) preliminary data, in the first half of the year 2024, the national electricity generation amounted to 3,783.4 GWh, of which RES accounted for 2,990.1 GWh. The generation was dominated by wind power plants with 1,703.1 GWh, thermal power plants with 793.3 GWh, solar power plants with 627.4 GWh, hydropower plants with 539.0 GWh, biomass plants with 64.8 GWh, biogas plants with 48.8 GWh, and battery technology with 7 GWh.

According to EPSO-G (a state-owned group of energy transmission and exchange companies), the grid’s renewable energy capacity increased by 549 MW in the first half of the year 2024 from 2,336 MW to 2,885 MW. In the first quarter of the year 2024, two solar farms were connected to the grid for the first time, with a total capacity of 145 MW. (Source: Ministry of Energy of LR).

AB IGNITIS GROUP – the parent company responsible for transparent and effective management and coordination of the Group companies while pursuing common strategic goals. The activities of the Group include green electricity generation and development of green and flexible technologies, energy distribution and supply, development of energy-smart solutions and other related activities.

AB „ESO” (ESO – energy distribution operator) is controlled by a state-owned group of energy companies Ignitis Group, and is one of the largest energy companies in the Baltic states. ESO is mainly involved in electricity and natural gas distribution, electricity and natural gas supply of last resort, connecting customers to electricity and gas networks, maintaining and developing the electricity and natural gas distribution networks, and ensuring the security and reliability of energy distribution activities. ESO serves 1.6 million customers throughout Lithuania and services an area covering 65,300 km².

The national electricity grid, which is mainly supplied from renewable energy sources (wind, solar, other) has significant balancing and storage needs, which are currently covered by the Kruonis hydro-accumulation plant. The main objective of this power plant is to ensure efficient electricity generation and trading on the NordPool exchange during peak and off-peak periods, to provide balancing capacity services and to trade balancing electricity on the regional market, while allowing the use of other renewable energy sources and the development of new generation capacities in the country.

Main technical characteristics of Kruonis HPP:

- Total capacity 900 MW, 4 units of 225 MW each.

- Cycle efficiency factor 0.74.

- Capacity in generating mode 160–225 MW. Maximum capacity 225 MW.

- Capacity in pumping mode fixed 220 MW.

KHPP is currently undergoing an expansion with the installation of Unit 5. The technical capabilities of the new unit, both in generator and pump modes, will expand the power plant’s capacity utilisation spectrum and allow the plant to participate more effectively in the common European balancing market.

Another important energy project in terms of national security – Europe’s largest 200 MW battery system – has been officially launched at the Vilnius Transformer Substation from October 2023, enabling it to react in just one second in the event of a disturbance and helping to ensure the uninterrupted transmission of electricity. The system consists of four 50 MW battery parks, installed at electricity transformer substations in Vilnius, in Šiauliai, Alytus and Utena. They can provide continuous power for about one hour or until other sources of power generation come online, Kruonis HAE. The 200 MW and 200 MWh storage systems will contribute to the integration of renewable energy after synchronization with the continental European electricity grid. Battery parks will then be able to store electricity from solar and wind generation above consumption levels, and, if necessary, when consumption increases, to feed back into the grid the energy stored from renewable generation sources.

District heating & cooling sector (municipal)

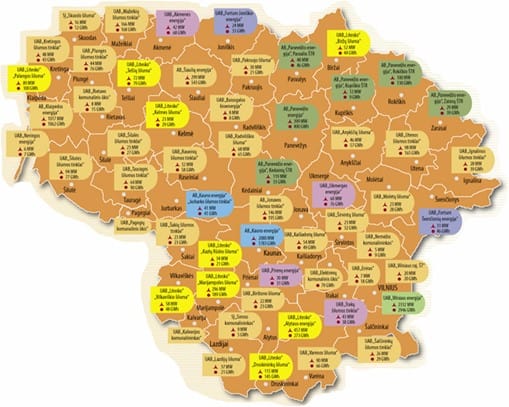

There are 45 municipal and regional district heating companies and 14 associated partners, which operate in the largest towns, settlements and some smaller locations in Lithuania. (Fig. 3). Lithuanian DH systems meet the efficiency criteria set by the European Union and are therefore considered energy-efficient. From 2021, connecting to DH systems is also encouraged by the new building requirements that have come into force, whereby district heating in Lithuania is recognized as suitable for A++ class buildings, as the majority of district heat is produced from renewable sources.

The total number of consumers is 727,000. In 2022, 8.6 TWh of thermal energy was fed into the grid. The structure of consumers supplied with district heating remains unchanged and here residential consumers are the main consumers, consuming around 70% (5,174 GWh) of the total district heating energy supplied. State organizations purchased around 15% (1,077 GWh) and businesses another 15% (1,104 GWh) of the total heat.

The average annual heat consumption in residential buildings in 2022 was 135 kWh/m2, which is around 15% lower than in 2021 due to milder winter weather. Different buildings consume different amounts of heat to maintain the same indoor temperature. Uninsulated and non-renovated apartment buildings, where the internal heating and hot water systems have not been upgraded, consume the most heat.

Figure 3. Companies responsible for heat supply on municipal level in Lithuania’s municipalities (Source: Lietuvos šilumos tiekėjų asociacija (lsta.lt))

Boiler houses and combined heat and power plants operated by 45 municipal and regional district heating companies and 14 associated partners, accounted for around 60% of the total heat supplied to CHP systems. Another 40% was purchased from independent heat producers (IHPs). There were 23 unregulated and 20 regulated independent heat producers in the CHP production market. The share of woody biomass (mainly wood chips and the renewable share of municipal solid waste) is currently over 85% of the fuel used in district heating in Lithuania.

The revised Heat law ensures that municipalities can plan for the sustainable development of their heating sector over a longer period. It provides for a shift to a 10-year planning period and two levels of heat sector planning documents – municipal heat sector-specific plans and 10-year heat sector development investment plans for heat supply companies.

Currently part of DH systems in Lithuania is installing and/or planning to install heat storage facilities, which will enable an increase the efficiency and enhance the living age of biomass-burning DH&C systems. These are mainly insulated hot water tanks and/or underground water tank storage.

Construction of two geothermal thermal power plants in Lithuania could start by 2028, as planned by Lavastream and Sage Geosystems. Currently, the first plant is planned for Klaipėda and the second for Gelgaudiškės. Negotiations are currently underway with the municipalities of Klaipėda city and Šakiai district, both for the land and for the possible connection of the plants to the heat network. Lavastream plans to install a thermal power plant with a capacity of around 30 MW in Klaipėda and 15 MW in southwestern Lithuania by 2028, as well as a geothermal-geological long-range electricity storage system. These plants will use new geothermal technology, which involves creating a reservoir at a depth of 3 to 6 kilometres and then injecting water or other liquid into it, which is warmed by the ground. This heated fluid would then be used for heating purposes. The technology could also act as energy storage to help “balance” solar and wind farms. In the future, Lavastream plans to enable the installation of geothermal-geological storage with a potential of 1 GW. The thermal potential of geothermal power plants in Lithuania is estimated at 20 GW, while the potential of geothermal power plants for electricity generation is over 2 GW.

Transport sector

The transport networks of Lithuania are part of the European single market and the driving force behind the competitiveness of markets. Transport according to the type of activities is divided into: roads and road transport; rail transport; water transport; and air transport.

Roads in Lithuania are divided into roads of national importance and roads of local importance, depending on their capacity for vehicle traffic and their social and economic significance. The total length of these roads is more than 84,000 km. The total length of national roads is 21 202.651 km, of which 1,751.257 km of trunk (main) roads; 4,924.577 km of national roads; and 14,526.817 km of district roads (Fig. 4).

Figure 4. Public transport map in Lithuania (Source: Lietuvos viešojo transporto maršrutai – Visi maršrutai (visimarsrutai.lt))

Roads of national importance belong exclusively to the State and are used and disposed of by the joint-stock company Lithuanian Automobile Roads Directorate under the right of entrustment following the procedure laid down by law and other legal acts. Roads of local significance are divided into public roads and internal roads. Public roads of local significance (and streets) are owned by municipalities, while internal roads are owned by the State, municipalities, and other legal and/or natural persons.

Most of Lithuania’s bus fleets are owned by municipalities, but the role of the Ministry of Transport and Communications is to shape the country’s transport policy. The organization of passenger transport on local routes and the calculation and payment of compensation for preferential passenger transport is an autonomous municipal function. It is up to the municipal councils to decide whether it is better for them to maintain their bus fleets or to privatize them and purchase passenger transport services from private carriers.

Transport sector. On July 1, 2024, a total of 23,003 passenger electric vehicles (M1 category) were registered in Lithuania, of which 13,481 were pure electric vehicles and 9,522 were externally charged hybrids. There were also 473 light commercial electric vehicles (category N1) on the register, of which 467 were pure electric vehicles and 6 were externally recharged hybrids. According to the Lithuanian Energy Agency, in June 2024, 733 light passenger electric vehicles were registered in the Lithuanian Road Vehicle Register (of which -363 were pure electric vehicles and 370 were externally charged hybrids). This is 19.45% less than in May this year, but 2.52% more than in June 2023.

One of the objectives of the National Energy and Climate Action Plan of the Republic of Lithuania for 2021-2030 is to increase the use of renewable and alternative fuels in the transport sector and to promote sustainable intermodal mobility. Currently, the transport sector is lagging behind the most. The objective is to achieve a 15% share of renewables in the transport sector by 2030. The Law on Alternative Fuels of the Republic of Lithuania stipulates that by 2025. M1 electric vehicles must account for at least 10 per cent and N1 electric vehicles must account for at least 30 per cent of annual purchase transactions.

Construction of the first charging park for electric vehicles started on the country’s main road from Vilnius-Kaunas-Klaipėda in 2024. The Eldrive Lithuania charging park will be the first of its kind on a major national road and will be able to charge 40 electric cars at a time. The park is scheduled to be operational in the first quarter of 2025. Lithuania is aiming to have around 120,000 electric cars by 2030. A convenient and well-developed charging station infrastructure is a key prerequisite for this ambitious goal. Around 60,000 public and private charging stations are needed.

Five 200 kW stations, each with two charging bays, are to be built on 1.5 ha of land. The first phase of the project will be completed next summer with five more 400 kW stations with two charging bays, bringing the total number of charging bays in the park to 20. The next phase of the park’s development will be the installation of high-power charging bays as well as several charging points for trucks or buses. Currently, there are more than 1,000 slow (AC) charging stations and around 300 fast (DC) charging stations in our country.

Biomethane

The first plants supplying biomethane to the natural gas grid have started operating, and green hydrogen will also be produced from biomethane. The development of biomethane would allow Lithuania to increase the use of renewable energy sources, reduce waste in agriculture and industry, and provide an economic boost to Lithuania’s biogas sector. By cleaning and upgrading biogas, biomethane can be produced with a methane concentration of 91%, which meets the quality requirements for natural gas. Biomethane can be fed into natural gas networks for use in the transport sector.

The Tube Green biomethane plant in Pasvalys has started operations and will produce 100,000 MWh/year of biomethane. This would be enough to supply 110,000 people in Lithuania with gas for a whole year or to fully meet 26% of the country’s gas-powered transport needs. The biomethane production project is being implemented by Tube Green together with bioethanol and biogas producer Kurana. The investment amount of the project is EUR 15 million.

Tube Green biomethane plant, in cooperation with Amber Grid, Lithuania’s gas transmission system operator, the biomethane plant has been connected to the country’s gas transmission network and is already supplying biomethane to the system. Tube Green plans to expand its activities in the future by considering the possibility of launching the production of synthetic fuels and green hydrogen. There are also plans to expand biomethane production capacity, allowing other biomethane producers to bring their biomethane to Tube Green and pump it into the main gas pipeline.

Hydrogen

Hydrogen is likely to play an important part in Lithuania‘s energy strategy. Notably, one of the NEIS objectives aims for Lithuania to emerge as a regional leader in green hydrogen production and export by the 2050s. Lithuanian gas transmission system operator Amber Grid, Energy Distribution Operator (ESO) and SG Dujos Auto have initiated a cooperation agreement on the development of Power-to-Gas (P2G) hydrogen technology. The project will see the first-ever connection of a green hydrogen plant to the Lithuanian gas system. The pilot project is expected to be completed and the production of green hydrogen gas using P2G technology in Lithuania will start in 2024. This research and development (R&D) project identifies how to adapt an existing gas system to transport green hydrogen. The project connects hydrogen production electrolysis plants to renewable electricity generation facilities and the gas transmission and distribution system. The hydrogen gas produced by electrolysis in the P2G plant will be blended in various proportions with natural gas and transported to consumers.

The first stage of hydrogen production expansion has already started with the location of a hydrogen production facility in Klaipėda Port. A 2 MW electrolyzer is planned for hydrogen production. The project, valued at 7 million EUR, is slated for completion in spring 2026 but the production is scheduled to commence as early as the start of 2026, with the first hydrogen expected by that spring.

The Lithuanian Ministry foresees substantial economic benefits from hydrogen production. By 2030, it could attract 2.2 billion euros in investments, creating 7,000 new jobs. By 2050, this figure could soar to 14.4 billion euros and 20,500 new jobs. Most of the hydrogen will be used as a raw material for ammonia production. Lithuania aims to export 33,000 tons of green hydrogen annually by 2030 and eventually incorporate hydrogen into electricity production during peak demand, exporting around 44,000 tons of green hydrogen.

This article was prepared by Farida Dzenajavičienė.